Role Of Blended Finance In Energy Transition

The Paris Agreement and United Nations Sustainable Development Goals, negotiated in 2015, represented an inflection point for moving from talk to action to address the world’s most significant challenge, “Global Warming”.

Recent studies have shown that we are getting measurably closer to temporarily reaching 1.5°C above the pre-industrial level for at least one of the following five years; this calls for countries to take concerted climate action to reduce greenhouse gas emissions to limit global warming.

The world continues to advance towards sustainable energy targets. Nevertheless, the current pace of progress is insufficient to achieve Goal 7: Affordable and clean energy by 2030. Huge disparities in access to modern sustainable energy persist, leaving the most vulnerable even further behind.

The combined challenges of energy access and climate change present major needs for clean energy investment.

The objective is clear: Achieving energy and climate goals by limiting global warming to, at most, 1.5°C while bringing electricity to the more than 1 billion people globally who do not yet have access to it. This objective requires mass mobilizing public and private capital for clean and renewable energy, especially in developing countries.

Blended finance is an innovative financing approach that leverages public or philanthropic funds to attract investment for sustainable development and enable access to large-scale projects such as low-carbon energy projects. This structuring approach uses small amounts of donor funds to mitigate investment risks through credit enhancements and loans. This has proved to be an effective impact-driven method of investment.

Public funds, such as government resources and international aid donor funds, are clearly not limitless, and with hefty sustainable development targets for the world to meet, blending these funds with private capital helps to supplement the shortfall in development capital.

Thus it has emerged as a critical tool to support the energy transition to a low-carbon economy, which is essential to mitigate the impacts of climate change.

However, current private capital mobilization rates by Multilateral Development Banks (MDBs) are currently less than 1:1 across their entire portfolios, according to the Blended Finance Taskforce. Furthermore, the task force estimates that raising enough capital to implement the SDGs fully would require leverage ratios closer to 4:1 or possibly higher still to 5:1 or 6:16.

Blended Finance Landscape

Even though clean energy costs have decreased significantly in recent years, risks and barriers remain in countries and prevent investment. The top risks identified are off-takers, currency, policy, liquidity, and scale risks. In addition, many early-stage projects and clean energy companies face barriers in accessing financing. Blended finance instruments often transfer the risks of a private sector investor to the public sector. Different tools transfer different risks that prevent investment in clean energy.

Risks Addressed by Blended Finance

Blended finance in clean energy can address both perceived risks and real risks.

Perceived Risks

Perceived risks typically stem from a lack of understanding or track record of a technology, business model, team, investment strategy, or asset class. These are risks that a blended finance initiative seeks to reduce through its implementation. The rationale for blended finance to address perceived risks is typically characterized as either providing a “demonstration effect” or transferring “pioneer risk”.

Real Risks

On the other hand, real risks are those investor barriers and risks that a blended finance initiative cannot reduce through its implementation – these are often macro-economic risks such as currency risks or risks such as off-taker credit-worthiness, which cannot be overcome, but can be transferred to another party at the project level through the use of the blended finance tool.

As detailed in table 1, blended finance instruments include direct investment into projects and funds through different types of equity and debt; indirect support through guarantees, insurance, hedging, swap, and derivative instruments; and finally, commercially oriented preparation support, which covers financial and technical support for early-stage development risks in project preparation. Each of these instrument types addresses different risks and barriers.

Trends in Blended Finance for Clean Energy

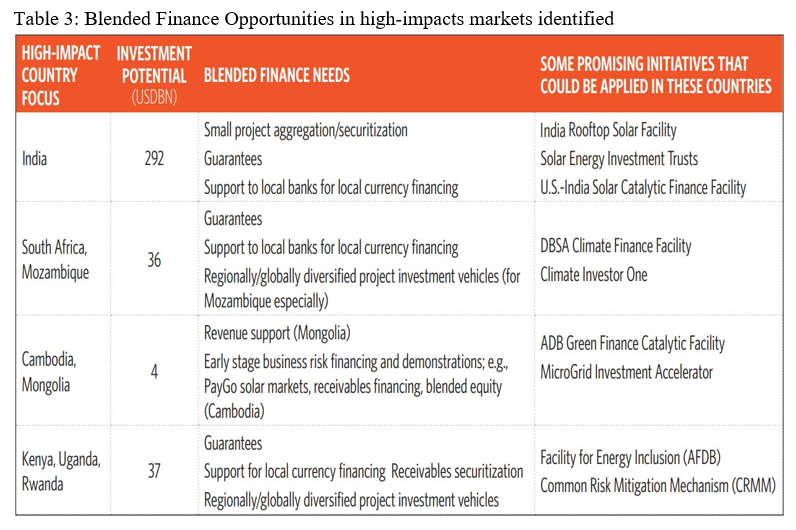

As per the report titled “Blended Finance in Clean Energy Experiences & Opportunities,” published by Climate Policy Initiative, below are some excerpts to summarise how blended finance has been deployed to date in clean energy and blended finance investment potential in high-impact markets.

Conclusion

Blended finance has the potential to play a critical role in accelerating the low-carbon transition in the energy sector as blended finance can help to bridge the financing gap for low-carbon energy projects. This can help to accelerate the deployment of renewable energy sources and promote the development of local energy markets, which are essential to the long-term sustainability of low-carbon energy projects.

Blended finance can also play a critical role in financing energy access in developing countries, where millions still lack electricity access.

Frequently Asked Questions

1. What are the potential risks and challenges associated with blended finance in the energy transition context, and how can they be mitigated?

Blended finance, which combines public and private funds to mobilize investment in sustainable development projects, including the energy transition, presents several potential risks and challenges.

Here are some of them and potential ways to mitigate them:

Financial Risks

Blended finance involves complex financial arrangements and structures, which can introduce risks such as inadequate investment returns, default, or insufficient funds for repayment. To mitigate these risks:

- Thorough due diligence should be conducted to assess the project's financial viability and risk profile

- Contracts and agreements should be well-defined, outlining the responsibilities and obligations of each party

- Diversification of investments across various projects and sectors can help reduce the impact of potential failures

Policy and Regulatory Risks

Changes in policies, regulations, or political instability in host countries can create uncertainties and affect the financial viability of blended finance projects. Mitigation measures include:

- Detailed analysis of the policy and regulatory environment to identify potential risks

- Engagement with local governments and stakeholders to understand their commitments and stability

- Integration of risk-mitigation instruments, such as political risk insurance or guarantees, into project structures

Project Development Risks

Many sustainable energy projects face challenges in their development stages, including delays, cost overruns, or technical issues. To address these risks:

- Thorough project planning and feasibility studies should be conducted to identify and mitigate potential risks early on

- Adequate project management expertise should be employed to ensure effective execution

- Strong monitoring and evaluation mechanisms should be in place to identify and address any issues promptly

Social and Environmental Risks

Energy transition projects must ensure social inclusiveness, respect for human rights, and environmental sustainability. Risks associated with social and environmental impacts can be mitigated through:

- Conducting robust environmental and social impact assessments prior to project implementation

- Engaging with local communities and stakeholders to address their concerns and ensure their involvement

- Adhering to internationally recognized sustainability standards and guidelines

Knowledge and Capacity Gaps

Blended finance initiatives require financial structuring, project development, and sustainable energy expertise. To overcome knowledge and capacity gaps:

- Building partnerships and collaboration between public and private actors can facilitate knowledge-sharing and capacity building

- Providing technical assistance and support to project developers in project design, financial modeling, and risk assessment

- Encouraging training and education programs to develop a skilled workforce in the energy transition sector

2. What potential innovations and new financing models can be explored to advance blended finance in the energy transition?

Several potential innovations and new financing models can be explored to advance blended finance in the energy transition. Here are a few examples:

Green Bonds and Sustainable Debt Instruments

Green bonds and other sustainable debt instruments can attract private capital by providing investors with opportunities to support environmentally friendly projects. These instruments can be used to finance renewable energy infrastructure, energy efficiency initiatives, and other sustainable energy projects.

Energy Performance Contracts (EPCs)

Energy Performance Contracts involve third-party providers implementing energy efficiency measures in buildings or industrial facilities and receiving payments based on the energy savings achieved. EPCs can attract private investment by leveraging the potential savings generated through energy efficiency improvements.

Results-Based Financing (RBF)

RBF mechanisms focus on paying for the achieved results rather than the inputs or outputs of a project. In the context of the energy transition, RBF can incentivize private investment in renewable energy generation by offering payments based on the actual energy produced or reduced carbon emissions.

Crowdfunding and Peer-to-Peer Lending

Online crowdfunding platforms and peer-to-peer lending networks can connect individual investors with sustainable energy projects. These platforms provide opportunities for retail investors to participate in the energy transition and support renewable energy initiatives.

Blended Finance Platforms and Facilities

Establishing dedicated blended finance platforms and facilities can streamline the process of mobilizing public and private capital for energy transition projects. These platforms can offer standardized financial instruments, facilitate matchmaking between investors and projects, and provide technical assistance and risk mitigation support.

Carbon Finance Mechanisms

Carbon finance mechanisms, such as carbon credits or offsets, can generate revenue streams for sustainable energy projects. By monetizing the environmental benefits of emission reductions or carbon sequestration, these mechanisms can attract private investment and support the financing of renewable energy initiatives.

Green Banks and Climate Funds

Governments can establish green banks or climate funds that leverage public funds to attract private investment for the energy transition. These institutions can provide concessional loans, grants, and guarantees to catalyze private capital and accelerate the deployment of renewable energy projects.

Innovative Risk-Sharing Instruments

Developing risk-sharing instruments, such as first-loss guarantees or insurance products, can help mitigate risks and mobilize private investment. These instruments can protect private investors against potential losses and give them greater confidence to participate in blended finance projects.

Blockchain and Distributed Ledger Technology

Blockchain and distributed ledger technology can enable transparency, traceability, and efficiency in financial transactions, making it easier to verify and track the impact of investments in the energy transition. These technologies can facilitate peer-to-peer transactions, reduce transaction costs, and enhance trust among stakeholders.

Impact Investment Funds

Impact investment funds specifically dedicated to the energy transition can pool resources from both public and private investors. These funds can be managed by experienced fund managers and directed towards sustainable energy projects to generate both financial returns and measurable positive social and environmental impacts.

Comments

No comments yet. Be the first to comment!