Journey Of Business Amidst Changing Market Trends

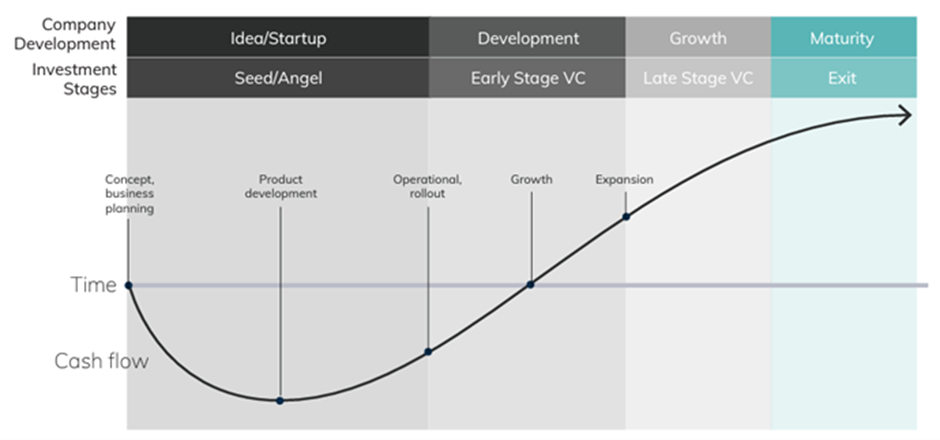

This article outlines the four key stages of business—Idea, Development, Growth, Maturity—exploring funding, challenges, and strategies for sustained success in a rapidly changing marketplace.

In the dynamic world of commerce, businesses constantly evolve to adapt to changing market trends, technological advancements, and consumer demands. The journey of a business involves several distinct stages, each marked by its unique challenges, opportunities, and goals. Understanding this evolutionary process is crucial for entrepreneurs and business leaders to successfully navigate the ever-changing landscape and achieve sustained success.

This article delves into the stages of business evolution:

- Idea

- Development

- Growth

- Maturity

Idea Stage

Every successful business venture begins with an idea. The Idea stage is the foundation upon which the entire business is built. Entrepreneurs identify opportunities, spot gaps in the market, or develop innovative solutions to existing problems. During this phase, thorough market research and feasibility studies are conducted to validate the viability of the idea.

Characteristics of the Idea Stage

Ideation and Conceptualization

This is the brainstorming phase, where ideas are conceptualized, and potential business models are formulated.

Business Plan

Entrepreneurs create a detailed business plan outlining the concept, target audience, competitive analysis, revenue model, and initial funding requirements.

Proof of Concept

Entrepreneurs may create prototypes, test products/services, or conduct pilot studies to validate the feasibility and demand for their idea.

Funding

Bootstrapping

Entrepreneurs often rely on personal savings or contributions from family and friends to finance initial research and concept development.

Angel Investors

Some startups seek support from angel investors who provide early-stage capital in exchange for equity ownership.

Crowdfunding

For certain business ideas, crowdfunding platforms can be utilized to gather funds from many individuals who believe in the concept.

Development Stage

The development stage begins once the idea is validated, and the business plan is in place. In this phase, the business takes shape as it moves from a concept to a tangible entity. Founders lay the groundwork for the company's operations, infrastructure, and initial market entry.

Characteristics of the Development Stage

Legal and Financial Setup

Entrepreneurs register their businesses, obtain necessary licenses, and set up financial systems to manage funding, expenses, and taxation.

Product/Service Development

The actual development of the product or service takes place, fine-tuning it based on user feedback and market requirements.

Team Building

Founders build a core team, defining roles and responsibilities to execute the business plan effectively.

Initial Marketing

Early marketing efforts focus on creating awareness about the product or service and building an initial customer base.

Funding

Seed Funding

Startups often seek seed funding from angel investors, venture capital firms, or early-stage investors. This funding helps cover product development and initial marketing expenses.

Venture Capital

As the business gains momentum, venture capital funding may be pursued to accelerate growth and market expansion.

Bank Loans

Some entrepreneurs may opt for bank loans to finance business setup costs and initial operations.

Growth Stage

The business enters the growth stage with the groundwork laid and the product or service ready for the market. This phase is characterized by rapid expansion, increased market share, and rising revenues.

Characteristics of the Growth Stage

Market Expansion

The business expands its reach to new geographic locations, target demographics, or complementary markets.

Scaling Operations

Processes are optimized, and resources are allocated efficiently to meet growing demand without compromising quality.

Brand Building

The company's brand identity strengthens, and customer loyalty increases through positive experiences and effective marketing.

Increased Competition

As the business grows, it attracts competitors seeking to capitalize on the same market opportunities.

Strategic Partnerships

Collaborations and strategic partnerships may be formed to leverage each other's strengths and widen market reach.

Funding

Series A, B, and C Funding

Successful startups may attract larger rounds of funding from venture capital firms through Series A, B, and C funding rounds to fund marketing campaigns, new hires, and market expansion.

Private Equity

As the business grows, private equity firms may invest in the company to support further expansion and diversification.

Strategic Partnerships

Collaborations with established companies may involve strategic investments or funding to facilitate joint initiatives and growth.

Maturity Stage

After a period of robust growth, the business enters the maturity stage. In this phase, the market becomes saturated, and growth stabilizes. The focus shifts from rapid expansion to sustaining market share and profitability.

Characteristics of the Maturity Stage

Market Saturation

The market becomes saturated, and the rate of customer acquisition stabilizes.

Diversification

To maintain growth, businesses often diversify their product or service offerings or explore new markets.

Cost Optimization

There is an emphasis on streamlining operations and reducing costs while maintaining the quality of products or services.

Customer Retention

Building customer loyalty becomes crucial as competition remains fierce.

Innovation and Adaptation

The business must innovate to stay relevant and adapt to changing market conditions.

Funding

Internal Cash Flow

Mature businesses often rely on their internal cash flow to support ongoing operations and investments in innovation.

Bank Financing

Bank loans or lines of credit may be utilized to finance specific projects, product updates, or technological advancements.

Merger and Acquisition

Some mature businesses seek funding through mergers and acquisitions, allowing them to combine resources and expand their market presence.

Conclusion

The evolution of a business from an idea to maturity is a transformative journey that demands strategic planning, adaptability, and resilience. Each stage presents its unique challenges and opportunities, and successful entrepreneurs and business leaders must be agile enough to navigate them.

Understanding the distinct characteristics of each stage enables businesses to make informed decisions, capitalize on growth opportunities, and create long-term sustainable value. By embracing change and proactively managing challenges, businesses can position themselves for continued success even in the face of an ever-evolving market.

Frequently Asked Questions

1. What key factors differentiate successful entrepreneurs and business leaders in navigating the various stages of business evolution?

Successful entrepreneurs and business leaders stand out with a clear vision, adaptability, and resilience. They prioritize innovation, customer focus, and strategic planning while managing risks effectively. Building strong teams, nurturing relationships, and continuous learning contribute to their sustained success, all underpinned by ethical conduct and efficient time management.

2. How can businesses proactively embrace change and remain agile in facing challenges and uncertainties?

To proactively embrace change and maintain agility, businesses should foster an adaptable culture, prioritize customer needs, monitor market trends, collaborate with others, and invest in continuous learning.

Agile decision-making, embracing technology, and risk management are essential, along with crisis management planning and a focus on innovation and iterative approaches.

3. What common pitfalls should entrepreneurs avoid during the various stages of business development?

Entrepreneurs should avoid pitfalls such as:

- Insufficient market research

- Premature scaling

- Neglecting customer needs

- Resisting innovation

They must prioritize financial management, legal compliance, and strategic decision-making throughout all stages of business development to ensure long-term success.

4. What are the trends and best practices in securing funding from venture capital firms, angel investors, and crowdfunding platforms for startups?

Securing startup funding from venture capital firms, angel investors, and crowdfunding platforms involves following trends and best practices. Venture capitalists focus on early-stage investments in high-growth startups, while angel investors seek diverse portfolios.

Equity crowdfunding gains popularity, offering backers ownership in startups. Trends include ESG focus, tech-centric investments, diversity emphasis, and impact investing. Best practices encompass compelling pitch decks, market potential demonstrations, team strength, and alignment with investors' interests.

Startups must showcase value propositions, use social media for outreach, and emphasize transparent, data-driven, and ethical practices to build trust with investors and increase the chances of successful fundraising in a remote investment landscape.

Comments

No comments yet. Be the first to comment!